ASB MAGAZINE: DHD and Modom have launched a crowd funding campaign with innovative online equity firm Equitise. Equity crowdfunding became accessible to all Australian’s over the age of 18 in January this year. Crowdfunding is a new way to invest that enables broad groups of investors (‘the crowd’) to fund early stage companies in return for equity. It helps these companies access the capital they require and gives investors a chance to invest in businesses they are passionate about. Equitise claim they want to make investing in private companies accessible, efficient and cool.

ASB MAGAZINE: DHD and Modom have launched a crowd funding campaign with innovative online equity firm Equitise. Equity crowdfunding became accessible to all Australian’s over the age of 18 in January this year. Crowdfunding is a new way to invest that enables broad groups of investors (‘the crowd’) to fund early stage companies in return for equity. It helps these companies access the capital they require and gives investors a chance to invest in businesses they are passionate about. Equitise claim they want to make investing in private companies accessible, efficient and cool.

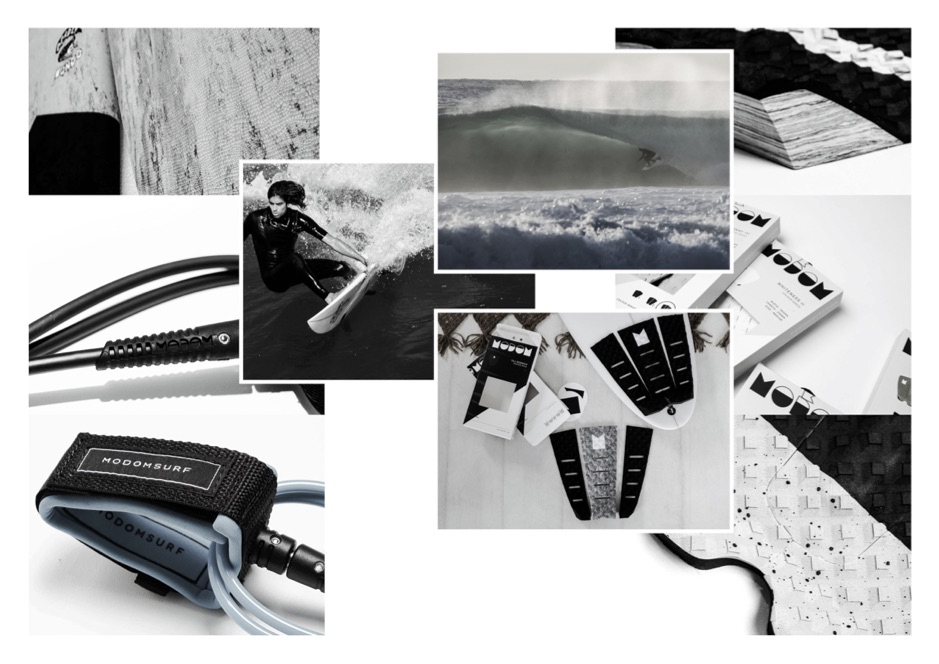

According to a statement from DHD over the last four years, the company has achieved considerable growth and attracted talented management that are focused on brand positioning and amplifying distribution channels. International sales represent 35% of revenue and with the introduction of EPS surfboards, DHD is well placed to increase this share. The company has also recently acquired Modom read (here). As an established and innovative brand with existing offshore production relationships, work practices and product ranges, Modom is the key to expanding the product range of DHD and tapping into the surf accessory industry. Modom also has a loyal customer base and its own impressive riders Craig Anderson and Taj Burrow.

DHD is raising capital to increase inventory, invest in product innovation and marketing. Alongside and in addition to these plans, the company also has major growth opportunities in the EPS and soft surfboard market as well as accessories and fashion.

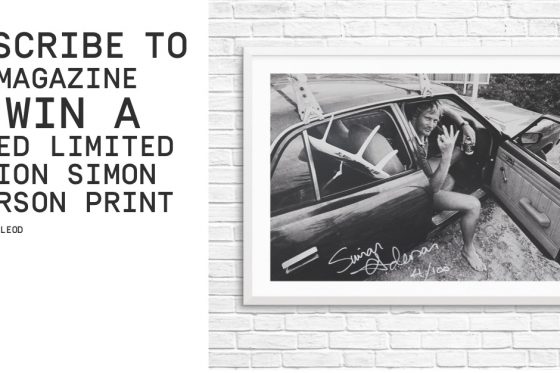

To own a piece of one of the world’s best surfboard brands, the company is calling to register your interest.

DHD was founded in 1984 and is now one of the leading surfboard manufacturers in the world. Born out of the world-famous surfing spot Kirra Point, the brand has grown both domestically and internationally, attracting some of the best surfers in the world including Mick Fanning and Stephanie Gilmore.

What Is Equity Crowdfunding?

Equity crowdfunding became accessible to all Australian’s over the age of 18 in January this year (2018). It’s a new way to invest that enables broad groups of investors (‘the crowd’) to fund early stage companies in return for equity. It helps these companies access the capital they require and gives investors a chance to invest in businesses they are passionate about. Retail investors can invest up to $10,000. Sophisticated investors are unlimited in their investment.

How To Invest:

Before investing, you’ll need to create an account with Equitise and then, once logged in, verify your identity. Both steps should only take a few minutes.

About Equitise:

Equitise was founded in Australia in 2014 by Chris Gilbert, Jonny Wilkinson and Panche Gjorgjevski with Will Mahon-Heap joining the team early 2015 coinciding with the launch of our New Zealand operations.

Chris, Jonny and Will have backgrounds in law, investment banking, financial services and equity capital markets. They also have strong networks in the early stage finance and VC sector in Australia, New Zealand and Singapore. Panche is the technology brain child behind Equitise. Equitise is an online equity crowdfunding platform connecting start-ups and high growth businesses, with a broad range of investors. We help businesses grow and thrive in a simple, intuitive and social way by disrupting the investment marketplace and removing the traditional funding barriers and costs.

We are creating an intuitive and automated investment ecosystem which is highly social and inclusive for ALL investors (from family offices, to VCs, high net worth angels and less experienced retail investors).

We want to make investing in private companies accessible, efficient and cool. This is achieved within our investment platform through syndicate investment clubs. A “syndicated group” is an umbrella term which covers VCs, Angel Groups and Investment Clubs.

The syndicated investment model sits within our equity crowdfunding technology and streamlines the traditional investment process for private investment groups. Syndicates enable private investment groups to fund their investments, share their investments with other investors in return for carry, get access to the Equitise Nominee (meaning only 1 shareholder on your shareholder register) – all whilst accessing the benefits of our technology.

Register your interest here: https://equitise.com/darren-handley-designs-raise