On December 1st 2017, Billabong International confirmed that it had received a confidential, indicative and non-binding proposal from Boardriders, Inc. to acquire all of the shares in Billabong, at a price of $1.00 cash per share, via a scheme of arrangement. At the time, it seemed like deal was far too complex, Billabong led chiefly by founder Gordon Merchant had famously rejected an offer more than three times the one that was on the table from Boardriders. The offer was also subject to all sorts of regulatory approvals and quite frankly we didn’t think it’d get through.

We were wrong. There was reportedly a team of some 150 persons who’d been working around the clock on the deal for 6 months prior to the public announcement. This included COPE Advisors LLC who served as lead financial advisor for Boardriders. Macquarie Capital, BofA Merrill Lynch, and Deutsche Bank Securities Inc. also served as financial advisors to Boardriders. Kirkland & Ellis LLP and Gilbert + Tobin served as legal counsel to Boardriders. Deutsche Bank Securities Inc., BofA Merrill Lynch and Macquarie provided acquisition financing to Boardriders. Goldman Sachs served as financial advisors to Billabong. Allens served as legal counsel to Billabong.

On January 4th 2018, Boardriders announced that it had signed a definitive agreement to acquire all of the shares of Billabong International. There were still a number of regulatory hurdles the deal had to go through, including a possible intervention of the ACCC, but from the moment the deal was announced Boardriders had their eyes fixed on the finish line.

Right on schedule, the 24th April 2018 Boardriders, Inc. completed the acquisition of Billabong International marking that date as a major milestone for our industry. In completing the acquisition these two businesses combined create the world’s leading action sports company with sales close to $1.9 billion in over 7,000 wholesale customers in more than 110 countries, owned e-commerce capabilities in 35 countries, and over 630 retail stores in 28 countries.

In four short months, the sale was complete. And now the real work begins.

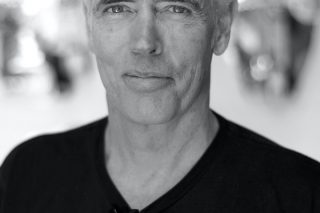

To better understand how a transaction of this magnitude might work from a legal standpoint, we reached out to Julian Blanchard principal of Blanchard Legal and who is a 30+ year qualified lawyer with broad experience: notably as general counsel for Billabong International.

***

You may have bought a house, in which you signed a contract, got your finance lined up, engaged a lawyer or conveyancer, signed a transfer and on the settlement date you (your bank) pays the purchase price (with some adjustments) and you get the keys to the house. Now it is yours, to love and to hold and forever maintain.

Is it the same for this type of transaction? Yes and no, but mostly no. it is way more complex. So how does it happen?

First up, Boardriders would have approached the Billabong Board of Directors with an offer at a certain price per share. That price was $1.00 per share (mind you, before the 5 to 1 share consolidation, that equates to 20 cents per share). The Board thought, at that time, that this was in the best interests of shareholders. Which means, in their view at that time, Billabong was going nowhere.

Billabong is a public company and was listed on the Australian stock exchange (ASX) and had many thousands of investors. There are three ways to buy an ASX listed company:

- By takeover, where a separate offer is made to each shareholder. Each shareholder either accepts or rejects the offer. If the buyer gets greater than 50% of the shares they then are assured that they have a majority of votes and can appoint all the members of the Board. Most buyers, for tax and accounting reasons, want to end up with 100% ownership. Then they can do absolutely what they want, not having to consider the interests of minority shareholders. They also reap 100% of any upside (and bear 100% of the risk of downside). Under a takeover, if 90% of shareholders accept the offer then the buyer can compulsorily acquire the minority 10% (even if those shareholders don’t want to sell, they can be forced to);

- By scheme of arrangement. Under a scheme, a shareholder meeting is called and shareholders vote on whether they want the merger to go ahead. That is, they in effect vote whether or not to sell their shares at the price being offered. If 75% of shareholders vote in favour, then the scheme is approved and ALL shareholders in effect sell their shares for the price. Even if a minority shareholder votes against the scheme, if the scheme is approved by 75% then that minority shareholders’ shares are transferred to the buyer;

- The listed company sells the underlying businesses to the buyer. The ASX listing rules requires that a sale of the company’s main undertaking requires approval of shareholders. There are often tax disadvantages to doing it this way, and involves a lot more legal work.

Boardriders acquisition of Billabong was by way of scheme of arrangement. So once the Billabong directors considered the price was right, the following steps occurred:

- The buyer (Boardriders) and seller (Billabong) sign a sale contract (called a scheme implementation deed);

- Boardriders prepares a scheme booklet that sets out all information that Billabong shareholders require to make an informed decision about the offer. That booklet includes an independent expert’s report that the offer is fair and reasonable (the range was $0.96 to $1.20 per share). That is a long document, nudging 190 pages;

- A court (in this case the NSW Supreme Court) has to approve the calling of the shareholders meeting;

- The shareholders meeting is called and a vote is taken. Interestingly, the Billabong meeting was deferred for ½ hour and when it reconvened the Chairman informed the meeting that Boardriders had increased its offer to $1.05 per share (no explanation was given as to why!). 75% of Billabong shareholders did vote to approve the scheme; and

- Boardriders goes back to court, the court approves the scheme and then finally the shares are transferred, Billabong is delisted and shareholders are paid a cheque.

Once all these steps have been taken, there are no keys to the house to be handed over. Whoever opened up head office (and other offices and retail stores) on the day before the acquisition would do so the day after. But there is a new owner. The immediate casualties are the Board of Directors of Billabong. They lose their positions immediately. That also includes Gordon Merchant, the founder (together with his ex-wife Rena). Gordon didn’t attend the shareholders meeting in person, but by telephone conference. Probably, a very gut-wrenching day for him.

There is inevitable a management shake-up too. Boardriders announced the new management team on the 24th. Very few from Billabong made that team, a notable exception being Shannan North, an extremely capable executive. Significant departures included the Billabong head of Australasia and the Billabong head lawyer (who had secured a new job elsewhere). Likely there will be more, as Boardriders seeks ways to cut costs and create efficiencies. For example, it would seem unlikely there will remain two head offices in Australia, at both Torquay and Burleigh Heads. No luck in sight for the goofy footers, but this type of big decision will have a very significant and flow on effects for many of its employees.

Julian Blanchard

Fashion Law: The Complete Guide by Julian Blanchard is available on Amazon or from www.blanchardlegal.com.au/book/

Fashion Law: The Complete Guide is a comprehensive guidebook to the Australian legal aspects of starting, operating, growing and selling a fashion brand. Topics include choosing a business structure, trademarks, copyright, counterfeits, social media, employees and contractors, manufacturing, labelling, importing, international expansion, leasing, wholesale, retail, consumer and competition laws, contract management, celebrities, ambassadors and athletes, events, photoshoots, films, insurance, tax, funding, buying another brand and exit (MBO, trade sale, IPO). The book is written using easy-to-understand English in a conversational style. The principal audience for the book are creatives who either want to DIY, or at least understand the broader legal aspects of running a fashion business.